E-purse Comes To Ireland: ACI Worldwide’s Visa Cash software plays a crucial role in an extraordinary technology project.

In the Irish town of Ennis, population 15,373, a man heads to work. On his way, he stops at a retail shop to pick up the Clare Champion newspaper, grab a bite to eat and use the public telephone to call his wife. When he arrives at work, he pays to park his car in a nearby lot.

It’s an ordinary day, but there’s nothing ordinary about how this man and other Ennis residents pay for such transactions. Rather than make small purchases such as these with cash, they use stored-value smart cards from Visa Cash.

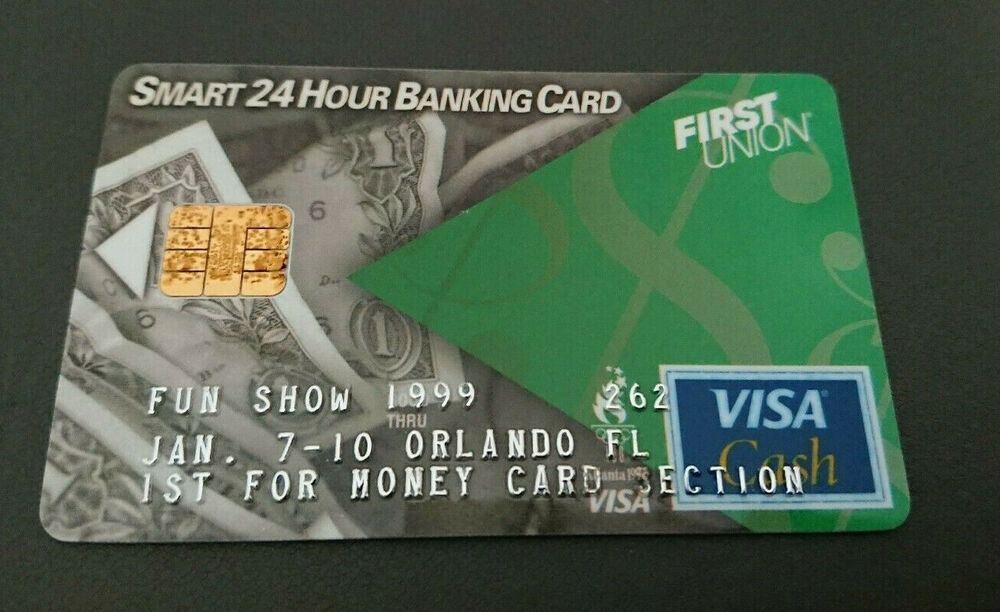

These cards let customers of Bank of Ireland (BOI) and Allied Irish Bank (AIB Bank) make small-value purchases. The Visa Cash stored-value smart card, which looks like a traditional bank card, contains a microprocessor that holds and processes money as electronic data. As the card is used at a terminal, money is deducted from the card’s chip and the amount of value remaining on the card is displayed.

Consumers can load and reload their cards with up to £50 using one of the self-service loading machines located throughout the town. Home devices are available to allow customers to reload cards from their homes. This electronic money then can be spent at participating merchant locations.

Smarter Than Cash

There are two types of smart cards used for electronic payments: electronic cash (e-cash) and electronic purse (e-purse). A key difference between e-cash and e-purse is the capability to make card-to-card transactions. This is important for accepting the stored-value card as a replacement for cash. The main concern is controlling the risk in permitting transactions without a central monitoring process, as there are fears that if system security is compromised, funds can be illegally injected into the system.

In our definition, e-cash systems do not have centrally controlled transaction-by-transaction audit trails because they permit card-to-card fund transfers. Mondex is an example of this scheme. E-purse systems do not allow direct card-to-card transfers because they require all transactions to be collected and settled through a central system. Visa Cash is an example of this type of scheme.

So what’s so special about the electronic payments smart cards used by Ennis residents? They are part of a £15 million project to make the town Europe’s first “Information Age Town,” a plan designed to make Ennis the breeding ground for leading-edge and experimental technology projects.

In October 1996, Ennis was selected in a nationwide competition to be Ireland’s Information Age Town. Visa Cash, the e-purse product offered by Visa International, was selected for a project by BOI, AIB Bank and Telecom Eireann, Ireland’s primary long-distance and local telecommunications service provider and the sponsor of the competition. Ennis was considered an ideal location to test an e-purse product because of its Information Age Town designation and because its residents have proven they are willing to use new technology.

Adding E-Purse To BASE24

To implement the e-purse technology needed for this pilot project, BIO and AIB Bank wanted to expand upon their existing ATM systems already in place rather than install an application from scratch.

That’s where ACI Worldwide entered the picture to give the banks the Visa Cash software solution they needed.

BOI and AIB Bank both use ACI’s BASE24-atm, the most widely implemented ATM software solution in the world. ACI engineers used the BASE24 Visa Cash application as the foundation upon which the Visa Cash scheme was implemented.

The components of this package includes support for loading funds using an existing BASE24-atm configuration, allowing the banks to load their customers’ e-purse cards. For the project, the banks licensed ACI’s NDC device-handler extension for Visa Cash, which expands the functionality of BASE24-atm by allowing the device to receive stored-value messages for routing and authorization.

“We were looking for a Visa Cash solution that was scalable and could be integrated into our current ATM system,” says Joe Kinane, BOI’s technical project manager for the Visa Cash implementation. “Although we implemented a standalone loading device from another company, we wanted the option of providing loading capabilities through our ATMs in the future. We also felt we are providing a base for the acceptance of chip-based debit and credit cards.”

BOI, AIB Bank and ACI worked together to resolve security issues and so the implementation would support smart card token information. BOI and AIB Bank also jointly developed the software’s interface so customers of each bank can use any card loading device. The e-purse cards are accepted at both banks, Kinane says, and there is no bank branding on any of the loading devices.

The project was further developed when Telecom Eireann issued personal ATMs (PATMs) to the bank’s Ennis customers in February 1999. These devices provide customers with card-loading capabilities in their own homes.

“This home service is a convenient alternative to the street-based loading devices,” Kinane says.

Using BASE24-atm allowed the banks to extend their technology platform to support PATMs. ACI provided the banks modifications to the ISO host interface, allowing PATM transaction messages to be supported. This lets the banks’ customers access their accounts and load their purse cards securely and conveniently from their homes.

Building Upon BASE24

ACI plays a major role in providing financial institutions, switches, processors and retailers software systems designed to process online real-time transactions. As technology evolves, our customers must continually leverage their payment processing infrastructure and delivery channels. To date, most self-initiated financial and payment services offered to consumers have been based on the magnetic stripe card.

With the emergence of the chip-based smart card, today’s products must help extend payment processing and service distribution to financial institutions as well as to individuals. Chip technology effectively delivers both the versatile functionality and the necessary security open payment systems demand.

Although chip technology has been used with prepaid telephone and stored-value cards for years many other applications are being considered. Because of the superior storage capacity increased reliability and data security inherent in chip technology (versus magnetic stripe), it increasingly is used to address the growing interest in supporting multiple applications on a single chip. The road is being paved to convert existing payment transactions (such as ATM, debit, credit) and non-payment transactions (such as loyalty, access, health care) from magnetic stripe to chip-based technology.

ACI’s chip card strategy is simple: The company will build upon our customers’ investment in BASE24 to extend their products and services through new and existing delivery channels using chip technology.

Chip-based cards will offer ACI customers more secure debit and credit products support multiple-application card services, provide more secure ways to initiate remote banking and electronic commerce payments and support e-purse or e-cash pilot programs such as the one in Enms. We will provide customers with one financial service and payment processing engine to support their existing and chip-based technology products and services.

ACI continues to develop its experience and expertise with chip-based technologies. We have helped customers worldwide implement advanced chip-card programs such as smart card-based debit and credit. Visa Cash, Proton, Chipper, Geldkarte, CLIP and proprietary e-cash schemes as well as Mondex e-cash. The company has added to its delivery capabilities through the recent acquisitions of Smart Card Integrations Ltd. (SCIL) and Media Integrations (MINT). This has extended ACPs core solution capabilities for Mondex, EMV support and implementation expertise.

ACI’s product suite provides customers support for the basic processes required for multi-application smart card operating systems. These processes allow cards to be produced and issued and for remote loading and application removal on cards with multiple-application chips.

In addition to supporting stored-value schemes such as Visa Cash and Mondex, ACI is now positioned to offer customers solutions for electronic ticketing, multiple-application download, identification and authorization for a variety of new chip-based services.

As the Ennis project demonstrates, the use of chip-based cards to buy goods and services is growing, and ACI has made the commitment to be at the forefront of this payment-processing evolution.